Understanding different kinds of debt funds

Mutual funds gather money from a lot of investors and create a corpus to invest in equity or debt or in both. Debt mutual funds are funds that invest in in fixed income instruments like corporate bonds, government securities and money market instruments. Debt funds strive to minimise risk by picking the least risky types of securities depending on each debt fund’s strategy and objectives.

Unlike equity mutual funds that seek to gain capital appreciation, debt funds attempt to give stable and relatively less volatile returns that are usually better than fixed deposits. They are mainly classified by their maturity and type of underlying instruments in the portfolio.

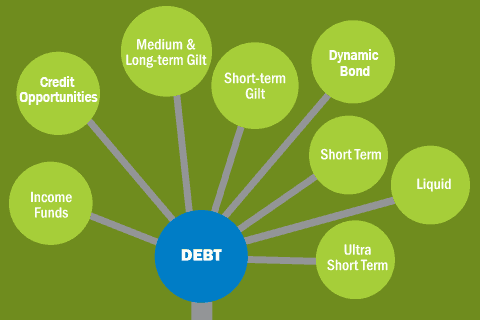

Debt funds classified as per their maturity are:

- Up to 3 months – Liquid funds, money market funds

- 3 months to 1 year – Ultra short-term funds

- 1-3 years – Short term funds

- More than 3 years – Income funds

Another way to classify debt funds is using their underlying portfolio (holdings). This will include funds such as gilt funds and credit opportunity funds.

Here are the different funds that are available.

Income Funds

These are a type of debt funds that attempt to provide stable rate of returns in all market scenarios. They primarily invest in an array of debt instruments of medium to long term maturities. Income funds run the risk of generating negative returns. The fund might invest in lower rated securities for higher returns. Income funds are suited for investors who have a higher risk appetite and longer investment horizon.

Dynamic Bond Funds

These funds seek to maximise the returns to investors by switching the investment portfolio depending on market conditions and fluctuations. They are dynamic in terms of the portfolio composition and maturity profile. These funds are an alternative for those wishing to ride the interest rate cycles. Fund managers choose securities as per the anticipated change in rates. For instance, during a falling interest rate scenario, the fund will invest in long-term instruments like government bonds.

Liquid Funds

Investors who want to maintain a high degree of liquidity and invest their surplus cash for a short time can choose these funds. This fund invests in securities and instruments that have a maximum maturity period of 91 days. Usually, only very highly-rated instruments are invested in, through liquid funds. These funds give higher returns than savings accounts and attempt to provide a similar level of liquidity.

Credit Opportunities Funds

These are riskier debt funds that invest in lower-rated securities to generate potentially higher returns. Anticipating a rise in ratings of papers, these funds invest in instruments rated under even “AA” in the hope that they will become higher-rated over time and increase in value. So, these funds primarily generate returns from interest accrual by investing in higher yielding but lower rated corporate bonds.

Ultra-short-term and Short-term Funds

Looking for a short-term investment with minimal risk exposure? Then, consider these funds. The securities that are invested in have a maximum maturity of three years and usually a minimum maturity of one year. The investment horizon of these funds is longer compared to Liquid Funds but shorter than Medium-term Income Funds. These funds generate higher returns when the short-term interest rates are high. These funds are best suited for low risk investors looking at an investment horizon of nine to 12 months.

Gilt Funds

These schemes invest in government securities which have a very low level of risk. These securities are also called gilts. So, the funds are called Gilt Funds or G-Sec Funds. Since only government securities are invested in, the default rate is very low and sometimes non-existent. However, the performance of these funds is highly dependent on the interest rate movements. So, they might give higher returns when interest rates are falling.

Fixed Maturity Plans (FMP)

These funds have a mandatory lock-in period that varies depending on the scheme. The investment can be done only once during the initial offer period. After this further investment cannot be made in the scheme. You cannot redeem directly through the fund house before the maturity date. However, you can sell them on the stock exchanges as the FMPs are listed. Since the volumes on stock exchanges are low, FMPs are fairly illiquid till maturity. The returns of FMPs are usually in line with the prevailing yields on fixed income instruments or fixed deposit rates.

Floating Rate funds (FRF)

These funds invest in securities that offer a floating interest rate. Floating rate securities are linked to a benchmark rate such as MIBOR. The interest rate is reset periodically based on the market movements. The primary objective of the fund is to minimise the volatility of returns.

Investing in debt funds

If you want to invest in debt funds, you should understand interest rate movements and bond market dynamics. For instance, when interest rates fall, bonds offering high interest rates gain. Bonds with more years left till maturity will gain more than the ones which have fewer years left to mature. When interest rates rise, the securities with shorter maturities are preferred so that they can be redeemed to buy new bonds offering higher interest rates. You need to look at the credit ratings too. The higher the rating of the debt instruments chosen, the lesser the risks the fund will have. So, choose your debt funds based on your risk profile and the investment horizon.