Review of Mirae Asset Emerging BlueChip Fund

Should you invest in Mirae Asset Emerging BlueChip Fund?

Mirae Asset Emerging BlueChip Fund is one of the most popular equity mutual funds, and it is categorised as a Large & Mid Cap Fund.

The fund invests 35-65% in large cap companies and 35-65% in mid cap companies. The fund allows investors to participate in the growth of young companies that have the potential to become blue-chip corporations in the future.

The fund’s net assets under management (AUM) was Rs.21,910.25 crore as of April 2022. Nifty Large Midcap 250 Index (TRI) is the fund’s benchmark.

However, it would help to keep in mind that new investors can invest in the fund through SIP. The maximum amount you can invest in the fund is capped at Rs. 2,500 per month. Currently, the fund doesn’t allow fresh lumpsum investment of any amount.

Now, let us see the Mirae Asset Emerging BlueChip Fund performance, risk parameters and portfolio allocation.

We took the fund’s regular plan and growth option into consideration for the review.Â

Rolling Returns of the Fund:

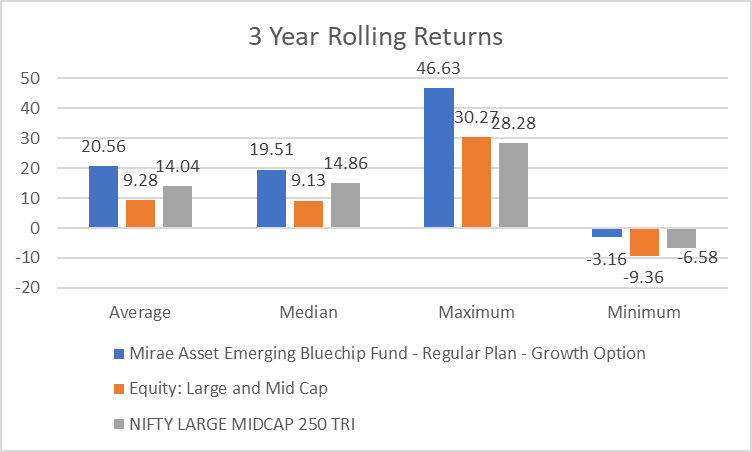

We compared the fund’s three-year rolling returns to its benchmark and category average to better understand its performance. We took the three-year rolling returns of the fund’s regular plan from 2013 to 2022. Â

Rolling returns are average annualised returns calculated over a certain time on any set frequency, such as daily, weekly, or monthly, and ending on the last day of the chosen period.

Source: Value Research

From this graph, we can see that Mirae Asset Emerging Bluechip Fund has outperformed the category and the benchmark from 2013.

Let us now look at the fund’s performance against its category and benchmark based on median, minimum and maximum three-year rolling returns.

Source: Advisorkhoj

This chart shows that Mirae Asset Emerging Bluechip Fund has performed better than the category and benchmark when we compare the median, average, maximum and minimum returns.

SIP Returns

A Systematic Investment Plan(SIP) is one of the easiest ways to invest in a mutual fund.

Let us see how the fund has performed if an investor started Rs.3000 monthly SIP in the fund five years back.

The total investment would be Rs. 1.8 lakhs, and the fund’s current value would be Rs.2.72 lakhs, giving a SIP return of 17.01%.

Mirae Asset Emerging Bluechip Fund is the second-best performing SIP fund in the Large and Mid Cap category after Quant Large & MidCap at 17.85%.

Returns Consistency

Return consistency is a critical factor in overall mutual fund performance.

The fund returns may fluctuate over time, depending on market movement and the fund manager’s stock selection decisions. This is why, before investing in a fund, you should check to see if it has consistently outperformed its benchmark over time and market cycles.

In other words, you must consider performance consistency. A consistent fund is one that consistently earns higher returns than its benchmark.

Return Consistency (% of times)

| Â | Less than 0% | 0 – 8% | 8-12% | 12-15% | 15 – 20% | Greater than 20% |

| Mirae Asset Emerging Bluechip Fund | 0.97 | 9.66 | 7.13 | 5.07 | 29.11 | 48.07 |

| Nifty Large Midcap 250 TRI | 4.09 | 13.82 | 10.22 | 23.44 | 30.17 | 18.27 |

| Equity: Large and Mid Cap | 10.75 | 30.82 | 27.12 | 9.2 | 17.68 | 4.42 |

Source: AdvisorKhoj

From the table above, we can see that Mirae Asset Emerging Bluechip Fund is a consistent fund. For 48% of the time, it has given returns higher than 20%. Moreover, the negative returns of the fund were less than 1%. On the other hand, the percentage of negative returns in the category was over 10%. Â

How does the fund perform on the risk parameters?

In addition to returns, we also need to check the risk parameters* of the fund. We will now see how the fund measure against beta, alpha and standard deviation.

Beta

The volatility of a mutual fund scheme relative to its benchmark index is measured by its beta. If a scheme’s beta is greater than one, it is more volatile than its benchmark. The scheme is much less volatile than the benchmark if the beta is less than one.

The Mirae Asset Emerging Bluechip Fund’s beta is almost one which is the same as the fund category. This means that the fund is as volatile as its benchmark. However, there were many funds in the category with lower beta.

Alpha

The excess returns compared to the market benchmark for a given amount of risk taken by the plan are referred to as alpha. If a scheme outperforms the benchmark, the alpha will reveal whether the outperformance was because of increased risk or the fund manager’s ability to provide superior risk-adjusted returns. The higher the alpha ratio in mutual fund schemes on a constant basis, the higher the long-term return potential.

The fund’s alpha was 3.67, while the alpha of the category was 0.39. Here, the fund was placed in the third position after Quant Large & Mid Cap and Axis Growth Opportunities Fund at 7.30 and 6.01, respectively.Â

Standard Deviation

Standard deviation in mutual funds shows how far your portfolio’s return deviates from the predicted return based on the fund’s previous performance. It’s the difference between the average and the variation in returns over time. A larger standard deviation indicates a wider range of returns, whereas a lower figure indicates a narrower range of returns.

The standard deviation of the fund is 22.03, which is less than the category. The lowest standard deviation in the category is Axis Growth Opportunities Fund at 20.28.

Portfolio

A major of the fund is allocated to the financial sector at 18.91%.

As per data on Value Research, as of April 2022, the fund increased its allocation to HDFC Bank, Shriram Transport Finance Company, Gujarat State Petronet, Max Financial Services, Tata Consultancy Services, Bharti Airtel and Crompton Greaves Consumer Electricals.

Since the last holding, the fund has reduced its allocation to ICICI Bank, JK Cement, Balkrishna Industries and NTPC.

Conclusion

The fund’s investment strategy is focused on quality stocks and growth at a fair cost. The fund maintains its outstanding track record.

As we can see from the data, the fund made the most of the market ups and downs. Fund managers Mr Neelesh Surana and Mr Ankit Jain manage the fund.

Note:

*The Risk Measures have been calculated using calendar month returns for the last three years, as of 31-May-2022

Data ranges from 08-Jul-2013 and 7th June 2022

The only money management App you will need

Download Wealthzi app now!