New NAV applicability date comes into effect from Feb. 1

A new framework on net asset value (NAV) applicability across mutual fund schemes upon realization of funds will now take effect from February 1, 2021 instead of January 1, 2021.

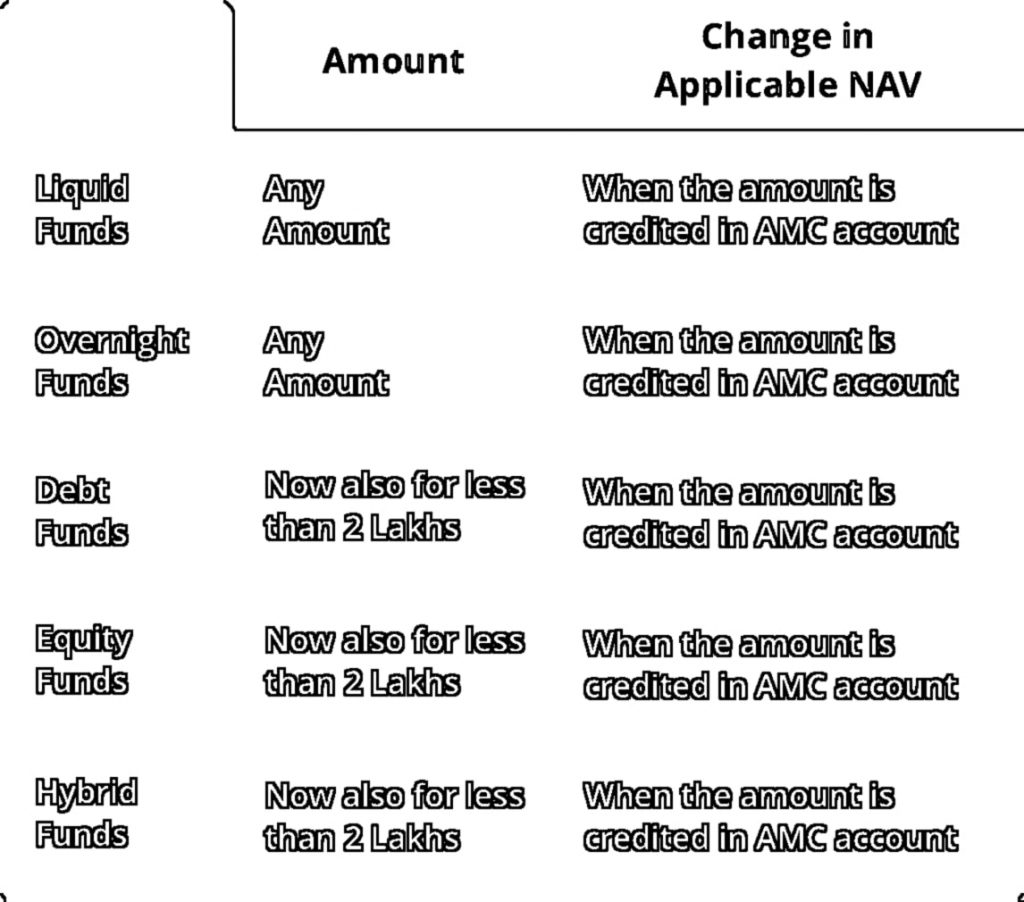

SEBI, in its latest circular, has extended the applicability date on new NAV rules to Feb. 1, 2021 from the earlier announced date Jan 1, 2021. The SEBI circular had previously said that investors would get NAV once the money reaches the fund house irrespective of the investment amount from Jan. 1, 2021. Now, mutual fund houses have time till Feb. 1 to follow these rules.

Do note that SEBI had said, except for liquid and overnight MFs, the closing NAV of the day will be applicable on which the funds are available for utilization irrespective of the size and time of receipt of an investment application. Currently, NAV for allocation of mutual fund units is based on the investment amount. For investment below Rs 2 lakh, allotment of units is based on the time of receipt of the application within a stipulated cut-off. In case the amount is above Rs 2 lakh, MF house allots units on the realization of funds from the investor.

But if the new norms took effect from January 1 it would have disrupted investor experience as well as impacted fund-houses’ ability to deliver service. This fear emerged due to the banking arrangements of mutual fund companies. The regulator seems to have taken cognizance of this concern.

In the case of NFO subscriptions, allotment date will be considered, irrespective of credit date & application submission date.

When an investor wishes to switch into NFO from an existing scheme, the switch-out will be processed on existing schemes. Switch in will be allotted on the day NFO subscriptions are allotted.

For online transactions, there may be a time lag in the transfer of funds from investors’ account to the AMC account and hence may differ from case to case basis.

Partial modification

Sebi has also partially modified its circular issued in September.

It said a fund manager may authorise an employee of the AMCs for order placement of equity and equity-related instruments of each scheme on his behalf, subject to certain conditions.

AMCs shall use an automated order management system (OMS) wherein the orders for equity and equity-related instruments of each scheme shall be placed by the fund managers of the respective schemes, Sebi had said in its earlier circular.

“Further, the orders in case of arbitrage transactions, stock lending and borrowing transactions, passive schemes (such as Index Funds and ETFs) and schemes investing primarily based on pre-defined rules and models, where the discretion of the fund manager is not required for placement of order, is not mandated to be placed through OMS,” Sebi added.

This is also subject to certain conditions.

Sebi, through its circular in September, had said that all orders of fund managers need to be received by dedicated dealers responsible for order placement and execution.

In its latest circular, Sebi said the requirement of a dedicated dealer shall not be mandatory in case of orders for arbitrage transactions, stock lending and borrowing transactions, passive schemes (such as index funds and ETFs), and schemes investing primarily based on pre-defined rules and models.

“All other conditions specified in Sebi circular dated September 17, 2020, shall remain unchanged,” it said.