Ethical and Sharia investing: What PMS, mutual funds have on offer

Ethical investing is a type of investing process that takes into account the investor’s personal values. These can be values linked to social, moral, religious, political, or environmental values. Companies which fit into these belief system are bought, while others are avoided by the investment vehicles. Let us take a look at what options PMSes and mutual funds offer in the ethical investing area.

PMS offerings

Ethical investing portfolios are a niche area in the PMS (Portfolio Management Service) arena. There are not many offerings. Do note PMS products have a minimum ticket-size of Rs 50 lakh.

Phillip Ethical India Portfolio is one of its kind that aims to invest into socially responsible companies and avoid companies that engage in activities that are deemed to be against beliefs. The emphasis is to invest in a diversified portfolio across market capitalisation to generate returns over medium to long term.

In short, Phillip Ethical India Portfolio is a multicap strategy for Shariah compliant stocks. It maintains a focused portfolio of around 20 carefully chosen stocks. The investment horizon is 3–5 years. The PMS strategy is benchmarked against Nifty500 Shariah. The strategy was launched in December 2017.

The rules and norms for Shariah compliant investment in stock market are divided into following three sections:

• Business and Industry Screening Parameters for Shariah Compliant Companies

• Financial Screening Parameters for Shariah Compliant Companies

• Purging of Impure (interest) Income for Investment in Shariah compliant Companies

Historical returns shows ethical investing pays off handsomely. Between 2013 to 2020, the NSE500 Shariah index went up 128 per cent compared to 107 per cent gain of NSE500.

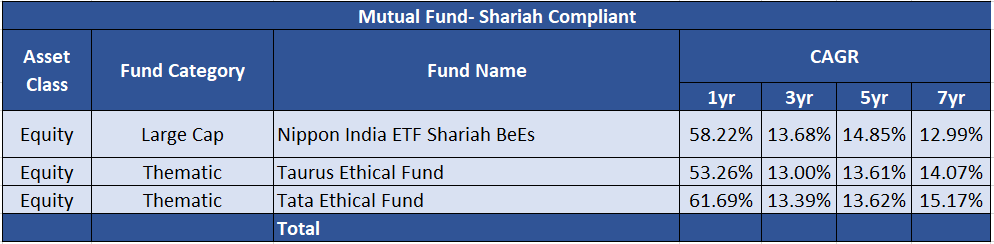

Mutual fund offerings

Ethical investing portfolios can also be found in MF space. These are mostly schemes launched many years back. Over the years, many such schemes have been merged with others.

Nippon India ETF Shariah BeES, launched in March 2009, is a passively-managed fund. It provides returns that, before expenses, closely correspond to the total returns of the securities as represented by the Nifty50 Shariah index. Nippon India ETF Shariah BeES is an Exchange Traded Fund (ETF) listed on NSE & BSE, which invests in stocks of Nifty 50 Shariah index in the same proportion as the underlying index. The Nippon India ETF Shariah BeES is less expensive than investing in individual securities of the Nifty 50 Shariah index. The Nifty50 Shariah index is a result of screening done by Taqwaa Advisory and Shariah Investment Solutions (TASIS) to provide the Shariah screens and filter the stocks based on these screens.

Taurus Ethical Fund, also launched in March 2009, is a solution for investors looking for suitable investment opportunities that comply with Shariah norms. The S&P BSE 500 Shariah Index is used as the benchmark for comparing the performance of this scheme. Taurus Ethical Fund uses a selection of stocks that is based on better management quality, good corporate governance and strong balance sheet with limited exposure to debt.

It invests only in listed Indian Stocks from S&P BSE 500 Shariah Index. Right now there are 65 securities in the portfolio. Top holdings include Infosys, TCS, Shree Cement, Voltas, The Ramco Cements, Tata Consumer Products, Maruti Suzuki India, Atul, Sun Pharmaceutical Inds., Bosch, Coromandel International, Berger Paints, Ultratech Cement, Thermax, MindTree, NMDC, Grindwell Norton, Tata Elxsi, HEG and Heidelberg Cement.

Tata Ethical Fund, launched in 1996, is the oldest running scheme in the ethical investing arena as far as mutual funds are concerned. Tata Ethical Fund is an open ended equity fund which invests in a diversified equity portfolio based on principles of Shariah. The investment objective of the scheme is to provide medium to long-term capital gains by investing in Shariah compliant equity and equity-related instruments of well-researched value and growth-oriented companies. Tata Ethical Fund buys stocks of companies with low leverage, sound capital structure and high cash generation.

For companies to be Shariah compliant, their total interest-bearing debt should not be greater than 25 per cent of their total assets. For companies to be Shariah Compliant, their receivables and cash & bank balances should not be greater than 90 per cent of their total assets. It does not have any exposure to the Banking & Finance sector. It avoids sin sector investments such as alcohol. At present, the fund has 43 securities. Top holdings include Infosys, TCS, HCL Technologies, Ambuja Cements, Tata Consumer Products, Dr. Reddy’s, Tata Elxsi, Carborundum Universal, Tech Mahindra, Hindustan Unilever and Siemens.

The only money management App you will need

Download our Wealthzi App Now